What is Due Diligence Process?

Due diligence is a solid review or audit of a company, usually undertaken before a merger or acquisition. The aim of due diligence in business is to ensure that any decision taken regarding the company in question is an informed one, maximizing your chances of adding value in an M&A transaction.

Due Diligence Review

The due diligence process throws up lots of information on the target company, across all of its operational areas. The goal of the due diligence review is to piece together all of this information into a coherent story.

This usually involves the people in charge of the due diligence process convening and deciding if there’s anything that was disclosed in the process that changes their initial opinion on a deal.

For example:

- Can the deal still go ahead?

- Should it go ahead with a certain set of covenants?

- What concerns should be raised with the target company?

These are typical of the questions that will arise during the due diligence review.

Types of Due Diligence

In mergers and acquisitions, we typically think of four major types of due diligence:

- Financial due diligence: Focusing on the financial performance of the company until the present date and ensuring that the numbers presented in the financial statements are accurate and sustainable.

- Legal due diligence: Focusing on all legal aspects of the company and its relationships with its stakeholders. Areas typically analyzed include licenses, regulatory issues, contracts, and any legal liabilities that may be pending.

- Operational due diligence: Focusing on the company’s operations – essentially looking at how the company turns inputs into outputs. This is generally considered to be the most forward looking type of due diligence.

- Tax due diligence: Focusing on all of the company’s tax affairs and ensuring that its tax liabilities are paid in full to date. Due diligence in tax also looks at how a merger would affect the tax liabilities of the new entity created by the transaction.

- Administrative due diligence: is the aspect of due diligence that involves verifying admin-related items such as facilities, occupancy rate, number of workstations, etc. The idea of doing due diligence is to verify the various facilities owned or occupied by the seller and determine whether all operational costs are captured in the financials or not. Admin DD also gives a better picture of the kind of operational cost the buyer is likely to incur if they plan to pursue expansion of the target company.

- Asset due diligence: Another type of due diligence conducted is asset DD. Asset due diligence reports typically include a detailed schedule of fixed assets and their locations (if possible, physical verification should be done), all lease agreements for equipment, a schedule of sales and purchases of major capital equipment during the last three to five years, real estate deeds, mortgages, title policies, and use permits.

- HR due diligence: Analysis of total employees, including current positions, vacancies, due for retirement, and serving notice period. All employment contracts, with nondisclosure, non-solicitation, and non-competition agreements between the company and its employees. In case there are a few irregularities regarding the general contracts, any questions or issues need to be clarified. HR policies regarding annual leave, sick leave, and other forms of leave are reviewed. Analysis of employee problems, such as alleged wrongful termination, harassment, discrimination, and any legal cases pending with current or former employees. Analysis of current salaries, bonuses paid during the last three years, and years of service.

- Intellectual property due diligence: Almost every company has intellectual property assets that they can use to monetize their business. These intangible assets are something that differentiates their products and services from their competitors. They may often comprise some of the company’s most valuable assets.

- Environmental due diligence: Due diligence related to environmental regulation is very important because if the company violates any major rule, local authorities can exercise their right to penalize the company, up to and including shutting it down operationally. Hence, this makes environmental audits for each property owned or leased by the company one of the key types of due diligence.

What are the Challenges of Due Diligence?

Gaining an in-depth understanding of a company can be a highly specialized process beyond most people without experience in the field.

There tend to be a myriad of challenges, but the following are usually among the most commonly encountered:

- Not knowing what questions to ask: It is vitally important to know in advance what the issues are and what diligence questions need to be asked to investigate them properly.

- Slowness of execution: Asking sellers to acquire documentation or information can take time, often with the consequence of delaying the transaction’s closing.

- Lack of communication: Sellers, even willing sellers, tend to regard due diligence as a hassle, leading to impatience, poor communication, and even friction.

- Cost challenges: Due diligence can be expensive, running into months and extensive specialist hours, making many erroneously think that they can cut corners.

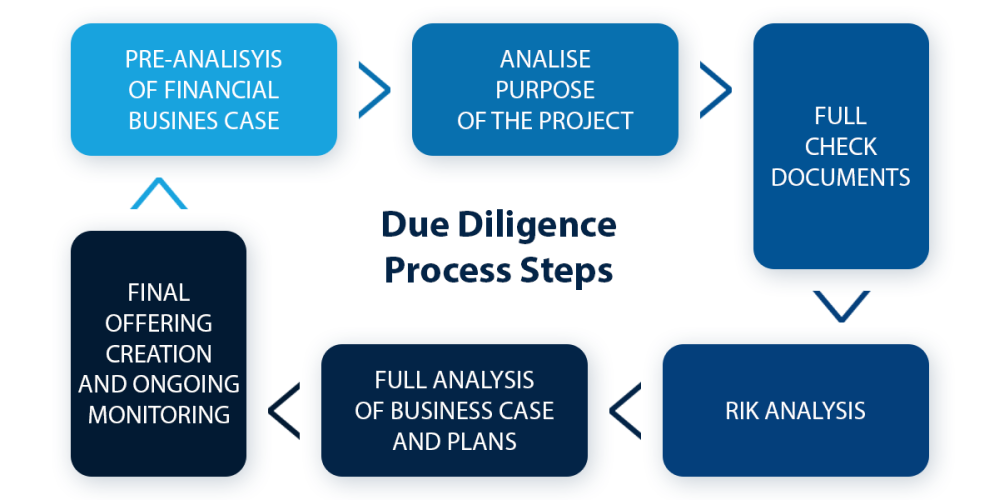

Due Diligence Process Steps

How Long is Due Diligence Period

While road mapping, it may seem difficult to forecast how much due diligence is enough. Despite its comprehensive nature, the due diligence process should only last between 30 and 60 days.

Management folder structure for M&A transactions

- Transaction Related Documents

- Corporate Documents

- Contracts and Agreements

- Customers, Sales, and Marketing

- Procurement (Suppliers)

- Property and Equipment

- Environmental

- Legal, Litigation, and Regulatory

- Intellectual Property

- Financial

- Tax

- HR and Employees

- Insurance

- Operations

- Information Technology

- Industry and other

Due Diligence on a Private Company

Unlike publicly traded companies, private companies are not auctioned and traded conventionally on the stock market.

Investors cannot easily buy shares unless they are founders, employed there, or have invested via venture capital or private equity firms.

Aside from it being more difficult to invest in private companies, they are not obligated to publicly disclose as much information. Compared to private companies, public companies are also held to stricter business and accounting practice standards.

While buying out privately owned companies and startups may have a high payoff and rewards, they come with distinct complexities. These may affect or hinder the M&A process.

Need Help?

Contact us at the consulting office or feel free to submit a business inquiry online.